Startup Investments in East Africa Beyond Kenya

If investors want to solve challenges and promote regional diversity, we need to invest in East Africa’s startup ecosystem beyond Kenya’s borders.

- Blog

- All impact sectors

- East Africa

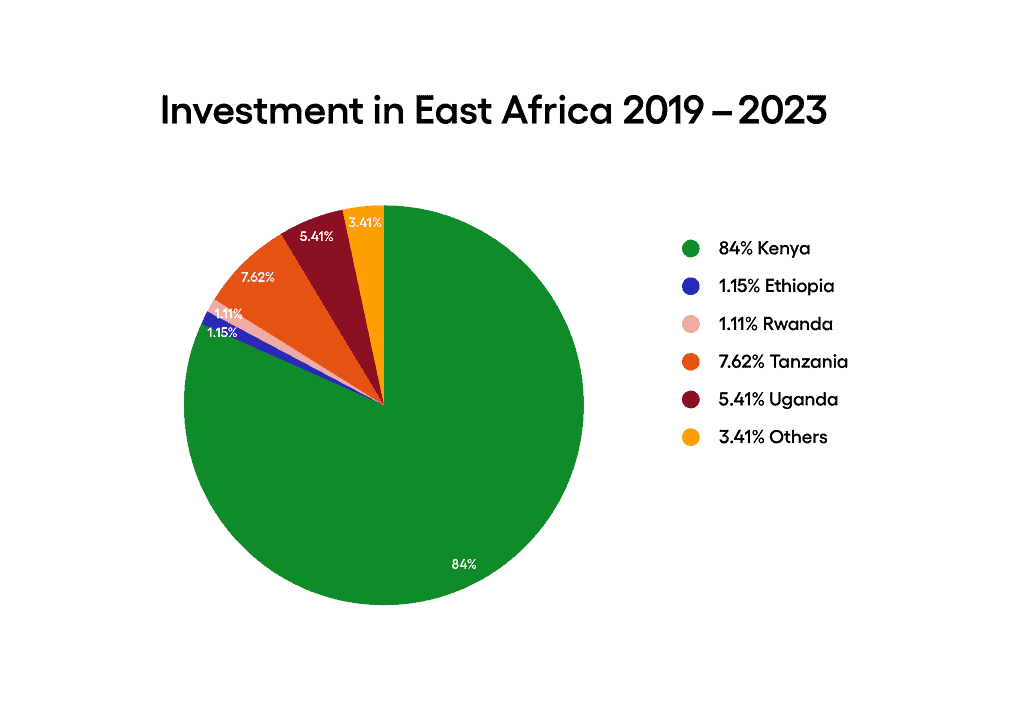

East Africa is not a monolith. The region is home to 14 countries, each with its own unique history, needs, and challenges, as well as economic, cultural, and regulatory dynamics. Yet, investment in East Africa is a monolith, or near enough: over the last five years, Kenya has attracted five times more investment than the rest of the region combined. As investors, we need to diversify our investments across East African countries. By doing so, we unlock opportunities to scale our companies’ impact, mitigate our own investment risks, and can even help attract additional investment.

Source: Africa: The Big Deal Database

Funding for Startups in Kenya

Over the last decade, East Africa has emerged as a significant region in the African startup landscape, and in the last five years, it has attracted approximately 21% of total funding on the continent, roughly proportional to its share of Africa’s population. But of all funding raised in East Africa since 2019, a staggering 84% was secured by startups in Kenya. In 2023, this percentage reached an even higher level at 94%.

Source: Africa: The Big Deal Database

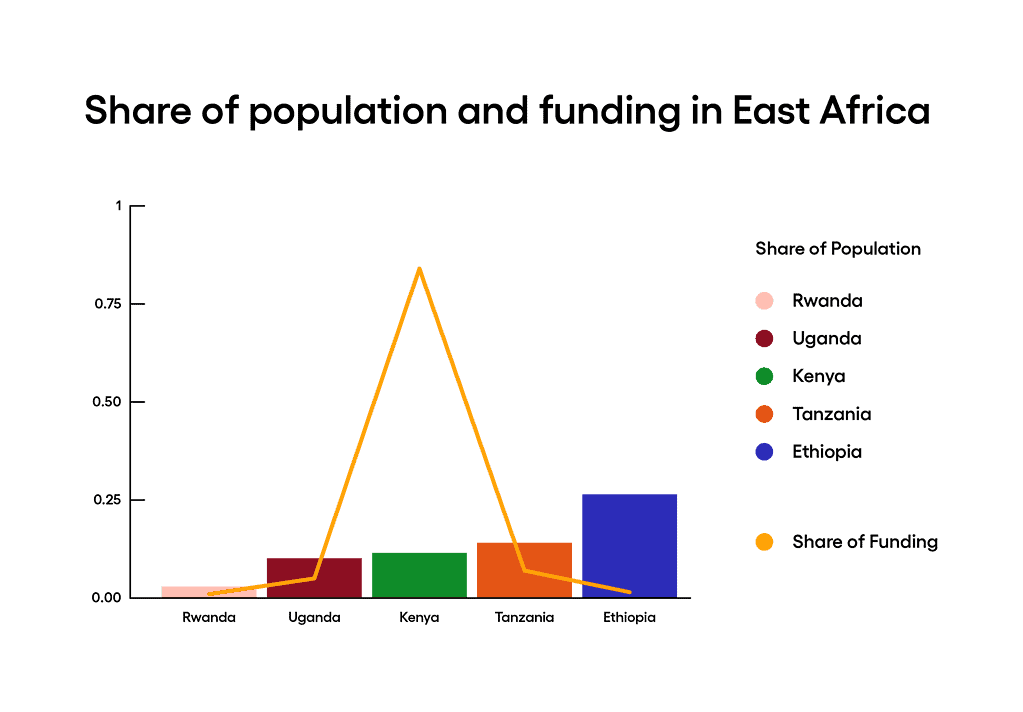

This disproportionate share of funding in Kenya is considerably higher than its share of the regional population (13%) or GDP (26%). The uneven distribution of funding can be attributed to the interplay of several factors:

- Geographic advantage: As the largest port in East Africa, Kenya’s Port of Mombasa serves as a key trading point and gateway to other East African countries, including Uganda, Rwanda, and Tanzania.

- Political enabling environment: Political initiatives, like the Kenya Vision 2030 and the Big Four Agenda, as well as Kenya’s status as a member of the East African Community create the enabling environment through investment incentives and trade opportunities.

- More mature market: Over the years, Kenya has built up a strong workforce, a mature startup ecosystem, well-developed financial infrastructure, and reliable infrastructure and internet connectivity.

- Higher GDP: With a GDP per capita over $2,000 USD, Kenya stands out as the sole low-middle income country in the region, with the rest classified as least developed nations, averaging a GDP per capita of around $800 USD. To investors, higher incomes means high demand for premium goods and services.

All of these factors jumpstart a virtuous cycle: an enabling environment attracts investment and funding, which allows entrepreneurs to capitalize on market gaps and opportunities, thereby fueling economic growth and solidifying attractive business environments. Local impact investment offices in Nairobi have further amplified Kenya’s appeal and seamless reach to investment opportunities.

“Regional investment and trading hubs are not inherently bad, but when investors disproportionately concentrate funding into one country in the region, we risk perpetuating inequities and leaving opportunities on the table.”

Regional investment and trading hubs are not inherently bad, but when investors disproportionately concentrate funding into one country in the region, we risk perpetuating inequities and leaving opportunities on the table. The term “developing countries” is often just a euphemism for underinvested countries. If impact investors want to solve complex, systemic challenges and promote regional diversity, we need to act on the burgeoning opportunities of East Africa’s startup ecosystem beyond Kenya’s borders.

The case for diversifying investments across East Africa

Taking a closer look at Acumen East Africa’s Portfolio, it becomes evident that the majority of our investments, eight companies, are based in Kenya, four companies have significant Pan-African operations, two companies are domiciled in Uganda and Tanzania, and one company in Rwanda. This concentration of investments in Kenya presents us with a challenge and an opportunity. Our challenge lies in promoting diversity within the East African startup ecosystem and expanding investments beyond Kenya. But it is also an opportunity to spur innovation, fill gaps in the market, and to begin to create the enabling environment for investing across East Africa.

When impact investors direct more capital to underinvested East African countries, communities can access critical resources, services, and solutions. For example, a 60dB study on the Rwanda-based company, Ampersand, showed that 93% of Ampersand’s customers had no prior access to an electric motorcycle like the one sold by the company. Eighty three percent of Ampersand customers who purchased a motorcycle reported an improvement in their quality of life, and 73% said they could afford household expenses that they couldn’t afford before. As one customer said, “Thanks to the Ampersand motorcycle, I’ve been able to renovate my house and afford clothing for my children.” By providing first-time access to an electric motorcycle, Ampersand can offer an additional source of income for families, while also building the market for e-mobility in Rwanda. When investors enable companies to scale those solutions, individual impact can become systemic change.

Investors and social enterprises that scale their impact can offer solutions to regional challenges, including climate change, refugee issues, and food security. When Acumen invested in Ethiochicken in 2013, 28 million people in Ethiopia could not afford or grow enough food to live on. But over the next four years, as the company distributed chicken breeds with lower mortality rates, stunting in the region fell 25%. The company’s success led them to expand and create Uzima Chicken, which replicated the model in Rwanda, Uganda, Kenya, and Burundi. Ethiochicken, in tandem with Uzima Chicken, became a catalyst for better nutrition and more affordable food in the region.

Beyond the impact incentive for investors, other countries are on their way towards creating the enabling environment. For instance, Rwanda’s stable tax and policy regime has created a conducive environment for investors, leading to increased foreign direct investment, economic growth, and development across various sectors. Rwanda’s investment priorities also signal an increasingly favorable business environment. A tenth of the country’s annual budget will be dedicated to improving transportation and infrastructure, while almost 15% will boost agricultural productivity and ensure food security. East African countries are making strides in trade terms, and the strength of their currencies against the Kenyan shilling reflects their growing momentum. The environment is increasingly there; now it’s our turn as investors.

Lessons from Investing in Kenya

While every country in East Africa is its own unique context, there are a lessons from Kenya’s trajectory we can apply to attract more funding and investment in other countries:

- Advocate for favorable government policies: While policy tends to be outside of the realm in which Acumen and our companies operate, we recognize that this is a critical factor for investors and social entrepreneurs alike. For instance, Kenyan regulations allow duty-free access to the EU markets for its exports, making trade much easier.

- Cultivate the entrepreneurial community: Back in 2010, iHub was one of the first innovation hubs in Kenya. Today, there are over 170 innovation spaces, in the form of hubs, accelerators, and venture studios, across Sub-Saharan Africa, demonstrating the impact of creating spaces to foster entrepreneurs, learning, and innovation.

- Invest in workforce: Kenya’s investment in education and skill development has cultivated a highly skilled and educated workforce. This talent pool, particularly robust in the technology sector, has been a magnet for investors seeking innovators, operators, and builders with whom to build new enterprises.

- Transform pain points into investment opportunities: The groundbreaking success of M-Pesa, Kenya’s mobile money platform, has transformed financial inclusion and established a dynamic fintech ecosystem. This pioneering innovation gained global attention and investment, positioning Kenya as a vanguard in digital finance.

Reduce Poverty in East Africa Through Investments

There are various ways investors can promote diversity in the East African investment ecosystem: actively scouting for promising startups in underrepresented countries; conducting comprehensive market research to identify high-potential sectors; establishing local partnerships with organizations, incubators, and accelerators; and regularly conducting scouting trips and collaborating with investor networks to discover and support promising ventures.

The virtuous cycle does not have one fixed starting point. Investors and the private sector can begin the cycle by putting philanthropic capital into emerging markets. More specifically, impact investors and philanthropists are the ones best suited to enter into new markets and take on the risk. It’s time we break the cycle of poverty by breaking into the virtuous cycle of investment.

More from Acumen

5 lessons for investing in East and West Africa

From tackling post-harvest loss to unlocking resilience in smallholder farmers, Acumen’s 2024 investments offer bold strategies to overcome East and West Africa’s toughest challenges and drive lasting change.