Hardest-to-Reach invests in d.light’s catalytic multi-country receivables facility

Acumen invests in Brighter Life by d.light, the first multi-country receivables finance facility formed by d.light and African Frontier Capital.

- News

- Renewable energy

- Sub-Saharan Africa H2R

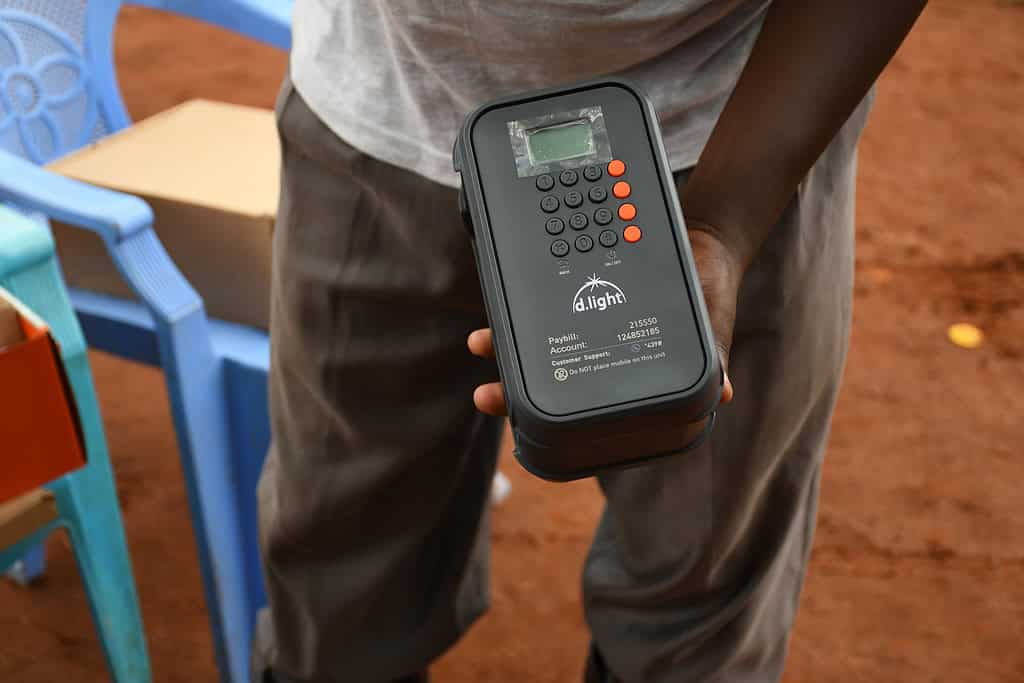

Acumen’s Hardest-to-Reach (“H2R”) initiative has invested $5 million in Brighter Life by d.light (“BLd”), the first multi-country receivables financing facility formed by d.light and African Frontier Capital (“AFC”). BLd purchases customer receivables generated from d.light’s solar home system sales in Uganda, Kenya, and Tanzania, enabling these subsidiaries to grow faster and reach more customers. H2R’s investment will fund d.light’s Ugandan receivables and is expected to serve 2.3 million people in Uganda with energy access, 1.9 million of whom will likely access clean energy for the first time.

Built to scale

Many solar home system companies like d.light sell solar products on a Pay-As-You-Go (“PAYGo”) basis, where customers pay in installments over months or years to make the products affordable for low-income customers. As a result, companies experience long cashflow cycles, slowing their ability to reinvest cash into the business and leading to many companies to take on a higher amount of debt to finance inventory and grow. By selling its receivables to BLd upfront, d.light’s subsidiaries will receive a higher amount of cash upfront, enabling them to expand operations faster and serve more customers without overburdening their balance sheets. Also, as d.light will sell its receivables in local currency, BLd reduces d.light’s exposure to foreign exchange fluctuations, thereby mitigating currency risk in a region that has faced significant currency devaluation.

Why Acumen invested

BLd and receivable special purpose vehicle structures intend to provide a myriad of benefits to its investors, such as isolating receivables from the originating company’s credit risk, being able to cater to different types of investors across different tranches, and reaching higher scale. This advanced receivable financing model paves the way for market innovation and sets a benchmark for impactful and inclusive energy financing structures across Africa.

Nedjip Tozun, d.light co-founder and CEO, said: “We are deeply grateful for Acumen’s new investment, which will empower even more people without reliable electricity access to experience the transformative benefits of clean, safe, and affordable energy. This partnership, alongside AFC, underscores the power of our flexible and scalable securitized financing mechanism to drive sustainable impact and expand energy access to those who need it most.”

Eric De Moudt, AFC CEO and Founder added: “We are very grateful to have Acumen’s support on this groundbreaking social impact securitization which is helping d.light bring financial inclusion and access to reliable and clean energy to millions of people across sub-Saharan Africa.”

Sandra Halilovic, Head of Acumen’s H2R development facility, stated: “Acumen’s investment will support a significant market innovation by funding one of the first and largest multi-country receivables financing facilities in Africa. As our first Hardest-to-Reach investment in Uganda, BLd aims to benefit millions of people across the country, making H2R’s funding highly impactful. We hope to see more structures like this one replicated in other regions to provide first-time energy access to people across the continent.”

About d.light

Founded in 2007 at Stanford in California, d.light is a global leader in making transformative products available and affordable to low-income families. d.light has sold over 35 million products, including solar lanterns, solar home systems, TVs, radios, and smartphones, impacting the lives of 180 million people. In 2024, d.light was named as a finalist in Prince William’s Earthshot Prize, which recognises groundbreaking sustainable solutions for repairing and regenerating the planet. d.light’s vision is to transform the lives of one billion people with sustainable products by 2030. For further information, visit www.dlight.com and connect with d.light on LinkedIn.

About African Frontier Capital

AFC is a social impact focused asset management company that has purchased $300 million of distributed renewable energy and related assets across Africa. It provides data-driven sustainable investment solutions (through structured finance & securitization instruments) that expand financial inclusion for low-income people. It has partnered with d.light on five receivables financing facilities to date and actively deployed climate capital in 4 different sub-Saharan African jurisdictions. For more information visit www.africanfrontiercapital.com or reach out via info@africanfrontiercapital.com.

About Acumen’s Hardest-to-Reach Initiative

Acumen Hardest-to-Reach is a $250 million initiative designed to activate clean energy markets in 16 of Africa’s underserved geographies. Using a variety of financial instruments, H2R invests in off-grid solar companies working to provide energy access for unelectrified households. Over the next 10 years, Acumen’s goal is to help achieve universal energy access in sub-Saharan Africa by electrifying 72 million people with solar products and avoiding 5 million tons of carbon emissions.