Solar Home Systems: Over-investment or overvaluation?

- Blog

- Energy

When you hear the term “unicorn,” you usually think of Silicon Valley. Your mind goes to companies like AirBnB and Snapchat, startups that seem to grow from zero to $1 billon overnight, not to social enterprises trying to bring energy to the poor. But we’re seeing a trend emerge in the off-grid sector, in which some young solar home system companies are being overvalued before they’ve had a chance to prove themselves.

So our concern isn’t with over-investment but rather overvaluation. In the last few months, I’ve spoken with an investor who was prepared to value a solar home system company projected to generate about $1 million in revenue at a pre-money valuation of $36 million. Do the math, and you’ll see that’s a lofty valuation by rational standards. At the same time, I’ve had conversations with entrepreneurs who refuse to budge on their valuation. One entrepreneur adamantly declared his company’s 300 unit sales demanded a valuation of upwards of $10 million simply due to “the market potential.” If Acumen had moved forward with that valuation, it would’ve been nearly impossible for that company to raise capital in subsequent rounds at even higher valuations—causing the company to fail and customers to be left in the dark.

From herd to stampede

In developing markets, copycat players create the impression that the solar home system market is limitless. Citing national and regional electrification rates as the market potential is often a company’s justification for why its business is worth capitalizing. Yet execution is tough, competition is growing, and operational risk is real. While we know there is tremendous work still to be done, overvaluing a company doesn’t help anyone—most of all the customer.

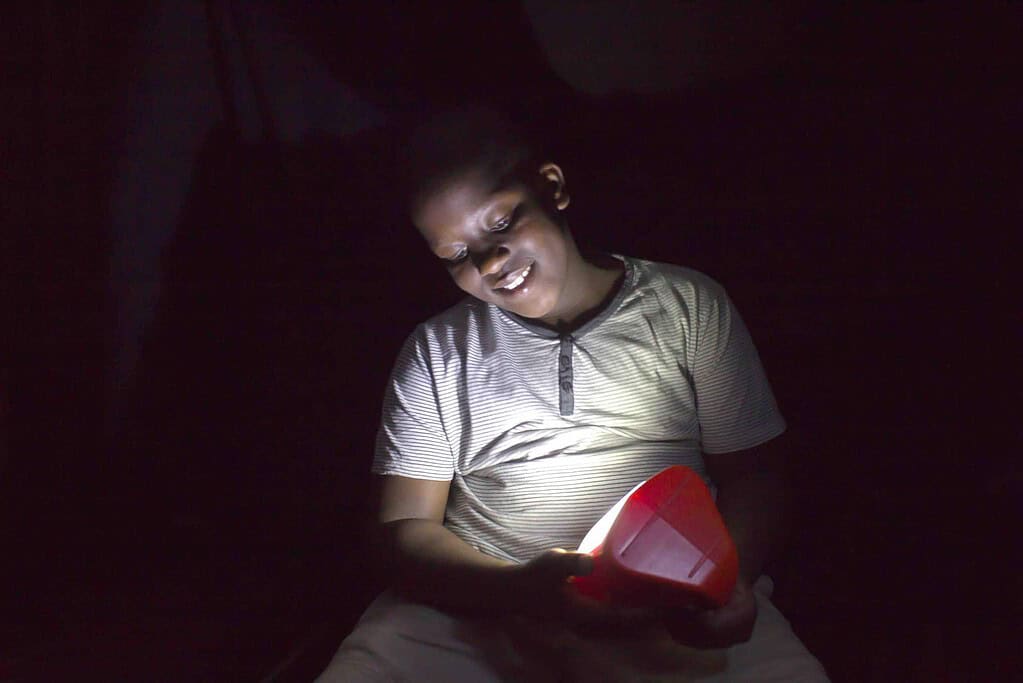

Why do we think overvaluing companies is a big deal? Overvaluation creates three significant effects. First, it creates a false sense of market success. As a result, governments may view the market as maturing and remove import duty waivers and subsidies on goods and services taxes. These incentive levers are still much needed for early unit economics to make sense. Second, overvaluing can hurt a company’s chance at raising future capital. If an early-round valuation is too high, a company may struggle to justify a future high valuation if it’s disproportional to its actual performance. And third, customers lose. Overvaluation may put pressure on margins in effect pushing prices beyond the reach of the customer. In many fragile markets, customers are enjoying the goods and services provided by solar home systems. If customers can no longer afford products or if the company can no longer scale, customers are literally left powerless.

An art or a science?

Just like any investor, we want to get the right value for our money to ensure our companies can grow sustainability in the future and attract capital at appropriate valuations as they mature. We believe it is important for all investors to think long-term and be patient with capital, especially in the off-grid energy sector.

With no milestone exits to date, no IPOs, and a need for a constant flow of cash, we do our entrepreneurs a disservice if we overvalue their companies early on in the fundraising process. Valuations should account for the real risks these companies face. At the same time, if we toss them an unreasonably low valuation, entrepreneurs could lose motivation to forge onward in this challenging market.

Placing a valuation on young companies in nascent markets is tricky and may seem more like an art than a science. With various methods like discounted cash flows and public and private transaction comparables difficult to use, it’s easy to resort to artificial valuation methods and get lost in the chatter of market potential. It is key to ensure we all employ our approaches with rigor and arm ourselves with as much empirical data as possible.

As a word to entrepreneurs, ask peers for guidance. We’ve come to know some talented, savvy entrepreneurs who understand the risks associated with their markets. By planning target valuations, having open, honest conversations with current and prospective investors, and seeking guidance from industry veterans, the payout of building a scalable business for the long term could be much greater than a short-term victory of attracting a high valuation.

A smarter way forward

There is a need for smart, exuberant investment in the next wave of solar-powered consumer and commercial technologies. Many portions of the off-grid value chain remain underdeveloped and putting appropriately priced capital to work is more needed than ever. At Acumen, we remain committed to investing in solar home system companies, especially those operating in new markets and offering product differentiation, because they showcase some of the most promising business models in energy access we have seen in the last decade. While they might not turn into unicorns, these companies have the potential to truly transform the lives of the poor, but proper valuations will ensure their financial sustainability and social impact along their path to scale.