The Top 10 Lessons We’ve Learned in Energy Access

- Blog

- Energy

- East Africa

Investing in companies in the energy access sector is both an art and a science. At Acumen, we leverage insights from both our portfolio and pipeline to sharpen our investment skills to ensure our capital is backing the most catalytic companies. Of course, it’s not always easy picking winners with more than 200 promising startups in the market, all in need of patient capital.

Looking back at what we’ve learned over the last decade, we put together a list of our top ten lessons, along with honest reflections of times when our theories were disproved. It is our hope that companies, socially minded investors, and thought leaders can employ these lessons to improve their business, refine how they invest, and assess where the sector can dedicate more time and support.

1. Customer service is the #1 pain point for mini-grid users.

When we started looking at investing in mini-grids, we expected low-income customers to identify price as their key pain point given the high capital costs associated with building them. After conducting a number of Lean Data projects with mini-grid companies within our portfolio and during our investment due diligence, we found that customer service and ease of use were, in fact, the areas where mini-grid companies struggled to deliver. Over a quarter of mini-grid customers we talked to experience challenges using their connection and inconsistent support to resolve their issues. A number of customers said that a company’s response time was too long, which sometimes resulted in the loss of a customer and thus lost revenue for the company.

What we’ve learned is that mini-grid companies need more comprehensive customer service and engagement strategies. Right now, it seems they focus on signing up customers, but not on supporting and servicing them. Companies and the off-grid energy sector at large need to invest time and resources to develop after-sales support that enable customers to get the full benefit out of their connection.

2. Solar home system companies need capital more quickly than they anticipate.

Most of the solar home system companies in our portfolio tend to believe the money they raise will cover them for two years, but the reality is these companies need to raise capital every 18 months or sooner. That’s because off-grid companies are inherently cash-intensive, offering products on credit with payback periods often extending beyond a year. They also run into a number of expensive obstacles, from unexpected VAT duties to key management hires to product write-offs, which can shorten a company’s expected runway. As a result, companies need to raise capital more regularly than every two years.

To address this issue, solar home system companies can create and implement internal systems that identify and prepare for costly issues while investors can work with these startups to understand their capital needs well in advance and size their fundraising rounds accordingly. These actions will allow entrepreneurs to spend less time on fundraising and more time on scaling their companies and ultimately reaching more customers.

3. Local companies are less visible than foreign-led.

A majority of Africa-focused off-grid energy tend to be led by American or European men. This isn’t inherently bad, especially if these companies are providing customers with access to energy in a scalable way. However, local entrepreneurs build businesses with more local context, leveraging preferences and behaviors of their communities to deliver products and services in ways that resonate. Supporting local entrepreneurs and companies operating in market is critical given many foreign-led companies, while committed, often try to address fundamental business model challenges from afar.

We are working to diversify the entrepreneurs we fund, both geographically and gender-wise, and dig deeper to build a robust pipeline. When considering a potential investment, we not only assess the company’s leadership, but we also look at its secondary level management and their capacity and willingness for growth.

4. Cleaner fuels show promise in revolutionizing cooking in emerging markets.

Clean cooking companies have developed stoves that burn biomass and charcoal more efficiently, resulting in reduced household emissions and deforestation, lower health risks, and improved household savings. Yet, less than $2 million in equity was invested in these companies in 2017. Of the three areas in which we invest, cooking companies are the most strapped for capital.

However, we believe that’s about to change. New but unproven business models are gaining initial market traction, including those offering pay-as-you-go technology and after-sales innovations to better support customers as they switch from traditional to cleaner cooking methods. Based on some of our Lean Data, these companies are showing impressive results in reaching the poor and creating very satisfied customers. This new class of clean cooking companies—including KopaGas, our most recent investment offering pay-as-you-go liquid petroleum gas in Tanzania—should encourage risk-tolerant investors to make more bets in this market to reach the three billion people who still cook with dirty fuels.

5. Hiring and retaining a CFO is a common challenge.

An energy access company requires a CFO capable of managing the complexities of operating in multiple geographies with varying currencies and financial structures. It’s no small feat, and finding the right person is a struggle for most of our energy portfolio. Top talent faces high opportunity costs when choosing between a solar home system company in a developing market or a more established firm in a developed market that can offer higher salaries and more security. A local company simply can’t compete on salary with international firms but can compete on mission and often times with compelling equity offers if the company is still in growth mode.

Pioneering off-grid energy companies need a very clear and crisp value proposition, whether it’s robust stock options or career development opportunities, that can attract top talent. That, combined with a strong, unwavering mission fueling the company, will be the incentive candidates need.

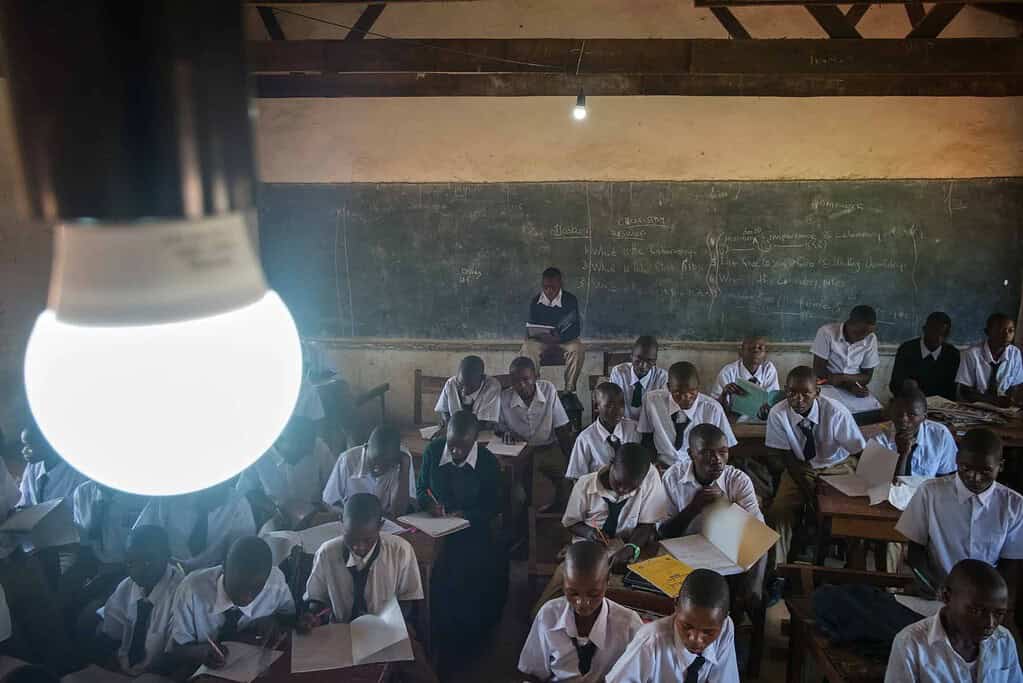

6. East Africa remains a hotbed of innovation.

The amount of pipeline we see coming out of East Africa is unparalleled. Roughly 66% of our latest investments, all early-stage, energy access companies, are from either Kenya or Tanzania. Additionally, companies that do have a choice on where to launch their off-grid products tend to move to Nairobi, Kigali, and other major East African cities due to network effects and visibility to investors and ecosystem players in a highly competitive market. We would like to see some of this innovation—and risk capital—cross over into West Africa and even some more overlooked markets like Pakistan. Right now, there are only a handful of innovative, tech-driven energy companies outside of East Africa. We would like to see the sector promote more grant challenges, like the Energy Access Booster, to support budding companies in new markets.

7. It’s early days for productive use technology but we see potential.

Many of the companies manufacturing and distributing solar-powered appliances, known as productive use products and services, are at the blueprint stage. The capital most appropriate for these companies, which have only a handful of pilots in the market, is grant capital to offer them the freedom to continue research and development, refine their products and secure necessary distribution partners. We expect to see the productive use market grow in the coming years as grant programs, such as DFID’s Low Energy Inclusive Appliances and Microsoft AirBand programs, support early-stage companies and ecosystem-building. Additionally, many productive use companies are partnering with mini-grid companies to increase energy utilization and drive demand for their grids. As technology, pricing models, and partnerships become more robust over the next few years, we expect to see an increase in investment capital, both debt and equity, to fuel these companies in their efforts to scale.

8. Valuations are all over the place in the energy access market.

We have seen some exorbitant valuations across the off-grid market. We find companies, whether providing solar home systems or clean cookstoves, rely on total market potential as a means to justify high valuations, but this doesn’t accurately reflect their value. Overly high valuations send the wrong signal because they set unreasonable expectations for how companies will perform and can ultimately set them back when it’s time to raise follow-on capital. Customers lose when companies cannot find financing partners willing to fund their company’s growth. With a dearth of capital in the market, the sector as a whole won’t benefit if prospective investors balk at unrealistic valuations.

9. Exits are difficult to achieve for energy access investors.

Exits are hard, especially for energy access investors because there are only a small number with enough capital to buy out early-stage investors’ shares. More efforts are needed to facilitate exits because the true marker of a successful investment and a viable market is the ability to exit a company and generate a return. Tracking return multiples is a good place to start to find new ways to crowd in untapped investors and increase the sector’s level of confidence in energy access companies as viable investments.

10. Customer experience, feedback, and insights are critical for growing a business and creating impact across the energy access market.

There is a lot of talk on how key knowing your customer is, but it’s often not something early-stage companies focus on early enough. If a company is not designing and delivering for customers then its ability to meet their needs, appeal to new markets, and grow its base is severely diminished. Our Lean Data work has enabled us to understand impact, learn about opportunities, and inform where we direct our capital, but it’s also supported our companies to gain independent and unbiased insights from their customers—often for the first time. Listening to customer voices, learning about behavior and usage, and identifying areas for improvement is instrumental to a company’s development. Otherwise, you’re building your business model in the dark.