Esusu

A credit-building platform helping low-income customers gain access to previously inaccessible financial services

- Company

- Financial Inclusion

- America

- 2019

The challenge

In the United States, the traditional credit scoring system excludes or disadvantages many low-income Americans by requiring proof of responsible financial behavior as demonstrated by having used products like mortgages and credit cards. Without access to many of these products, approximately 46% of Americans lack credit scores. These Americans must rely on expensive credit options like payday loans and often pay higher prices for basic needs such as utilities and phone services (where credit scores typically affect pricing) – inhibiting their ability to accumulate savings.

The innovation

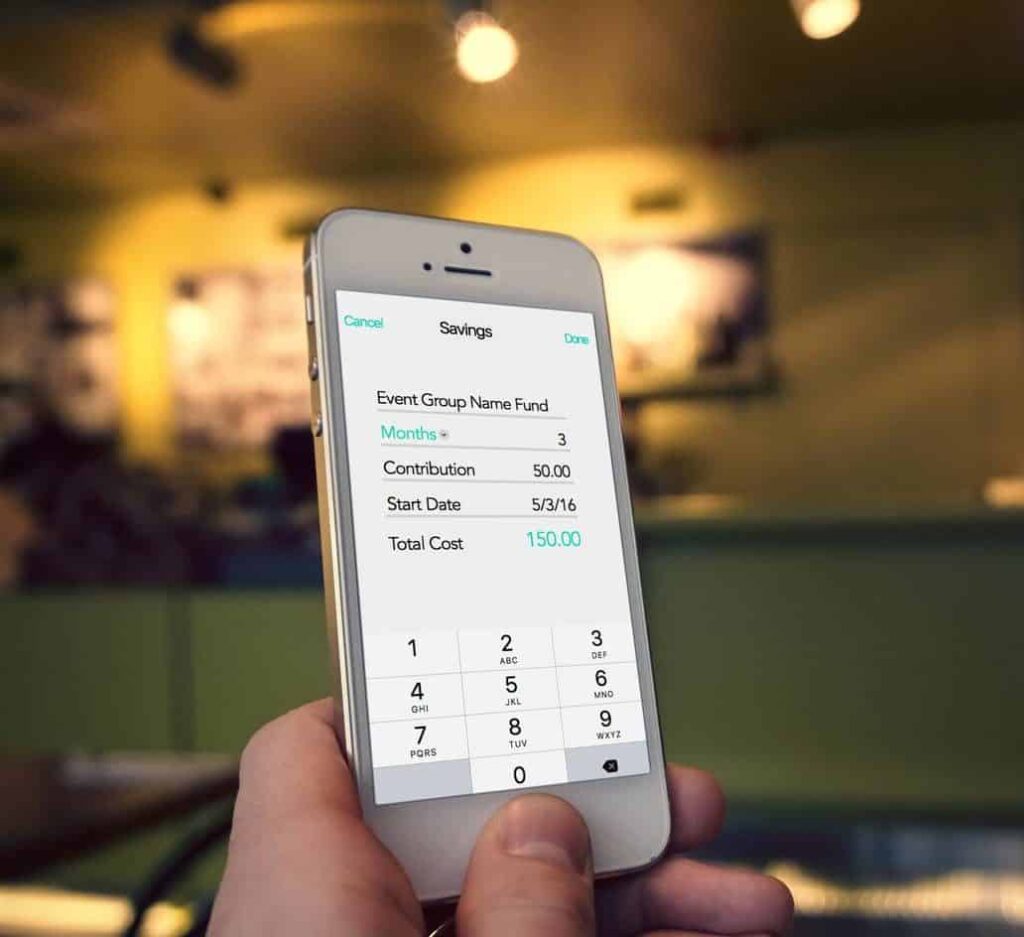

Esusu uses alternative evidence of low-income consumers’ responsible financial behavior such as rental payments and community savings group participation to establish or boost their traditional credit scores. Esusu’s rent reporting tool, the company’s main business line, sells landlords a property management platform to seamlessly report tenant rent payments to credit bureaus. Esusu’s user-friendly mobile app allows tenants to keep track of rent payments and monitor their credit score at no cost. For many of Esusu’s end users, reporting rent information creates first-time credit scores.

The impact

Esusu has served 40,000 end users to date – increasing low-credit users’ credit scores by an average of 30-40 points in as little as two months.