Three lessons for investors looking to measure impact on income

By focusing on the drivers of income, investors can better measure livelihood improvements for farmers and micro-entrepreneurs.

- Blog

- Cross sector

- Cross region

A couple more liters per day from the family cow; less income forked over for diesel to run the generator; a bit higher price for cocoa than the year before. The climb out of poverty is made up of incremental gains, a small but growing cushion for the inevitable setbacks, and no little amount of luck.

At Acumen, through investment initiatives like PEII+ and Trellis, we invest in companies that tackle problems of poverty. Although we have heard customers tell us for years that they saw improvements in their income, we had scant evidence for what that journey out of poverty looked like for an individual customer over time. This gap was especially evident with Productive Use of Energy (PUE) companies offering solar-powered appliances and services, as well as agribusinesses serving smallholder farmers. We wanted to put a number on customer income improvements, so we undertook a study to test new tools for measuring economic impacts over time. The results are in, and the evidence shows that social enterprises are, in fact, increasing the profitability of the farmers and micro-entrepreneurs they serve.

The research

We partnered with 60 Decibels to survey customers of three of our portfolio companies operating in the energy and agriculture sectors:

- Promethean: Through cold chain solutions and direct market access to farmers in India, Promethean expects to command higher prices for higher-quality milk, then use those premiums to pay farmers more than competing offtakers.

- Koolboks: Based in Nigeria, the company sells solar-powered refrigerators and freezers to shops and traders, ranging from a small, family-owned business to a large restaurant where a freezer is a fraction of the business operations.

- Lizard Earth: Lizard Earth works with cocoa smallholder farmers in Sierra Leone, providing them with training and market access, to improve the quality and price of the cocoa sold.

We worked with 60 Decibels to create a new method for measuring income changes over time. First, we conducted a baseline survey with recently onboarded customers who could recall their revenues and expenses prior to engaging with Promethean, Koolboks, or Lizard Earth. Second, we conducted an endline survey six months later to see how those revenues, costs, and profit had changed. Lastly, we complemented that data with monthly diaries and longer interviews to get a more holistic view of respondents’ financial health.

Drivers of income

Through those studies, we were able to identify and quantify the drivers of income, or the levers that enable companies to impact customer earnings. Rather than focus on total household income (which can come from multiple sources and is affected heavily by external forces), we looked closely at where companies can directly impact their customers’ earnings.

Our companies usually try to improve revenues and/or decrease costs for micro, small, and medium enterprises (MSMEs). An MSME can range from a cocoa smallholder farmer, to a small, family-owned business, to a large restaurant that uses a solar-powered freezer.

Since this covers all my household expenses, I have no problems. Payments are received on time, and I have household milk available, so I don’t have to buy it.

Dairy famer, Promethean

Companies can increase the price and/or quantity of goods sold by going deeper into value chains or re-distributing value towards MSMEs. On the cost side, companies can help MSMEs reduce operational expenses by offering alternative products like solar freezers that mitigate the need to purchase diesel fuel.

Promethean

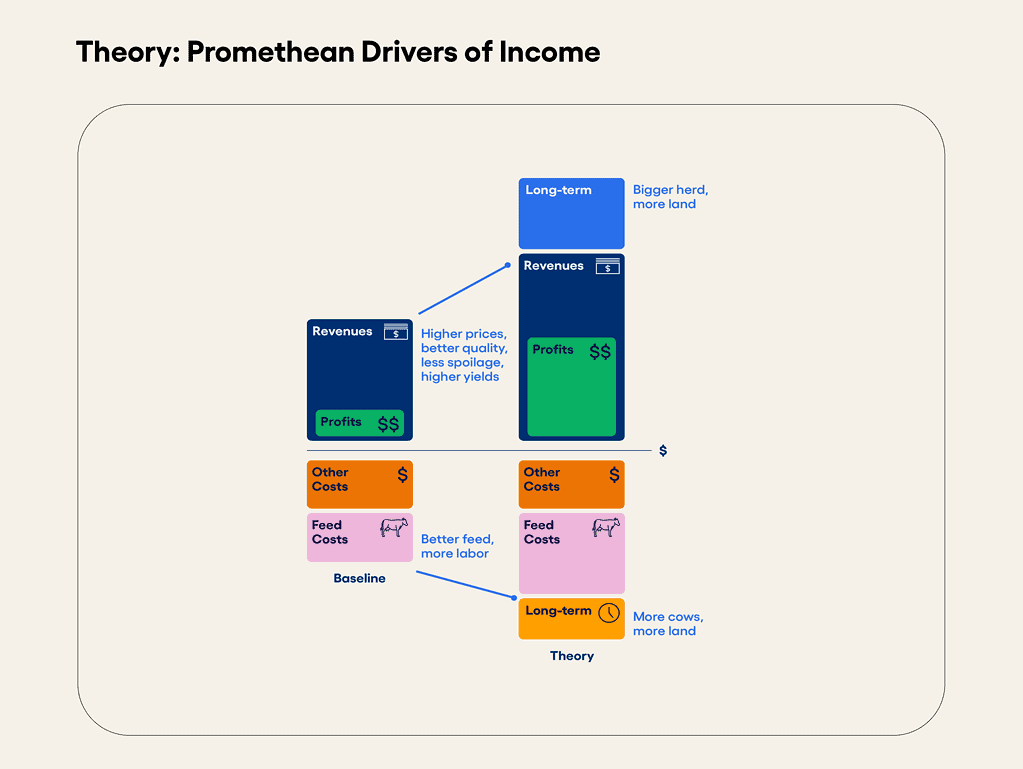

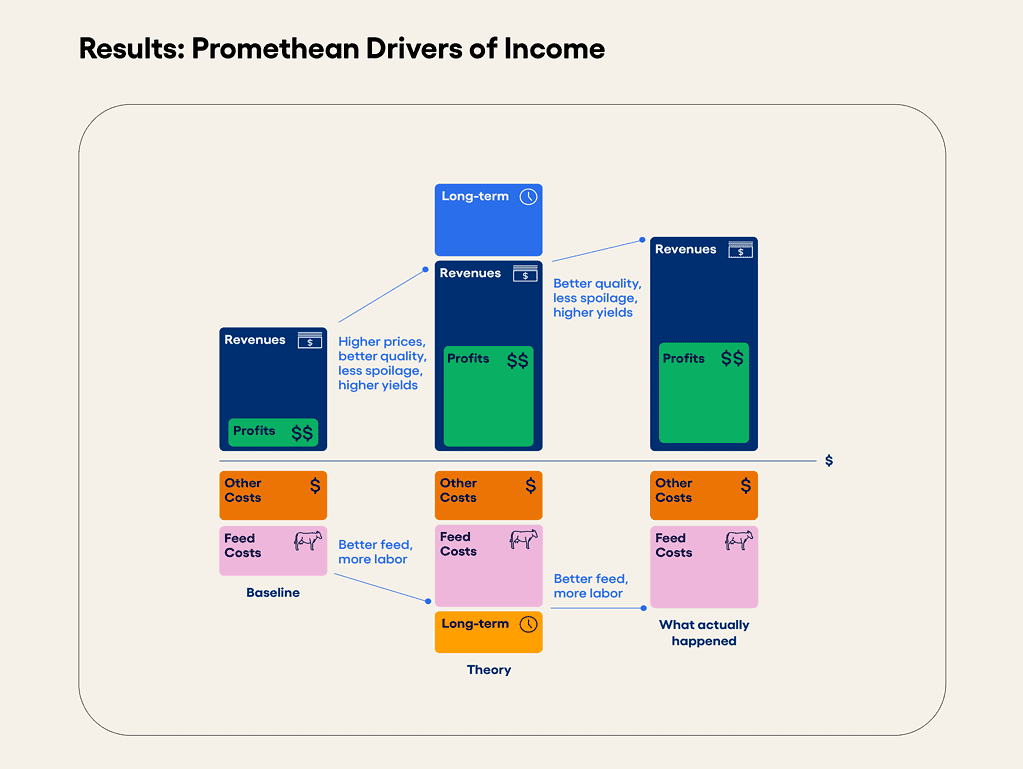

Take, for example, Promethean. As you can see in the diagram below, the company connects dairy smallholder farmers to buyers, with prices determined by the quality and quantity of the milk. It also provides last-mile refrigeration to reduce spoilage. Farmers are expected to spend more on feed and cows, but to benefit through increases in the size and yield of their herds. By focusing on drivers of income, companies like Promethean can actually identify the levers they can control, measure their impact, and take appropriate action.

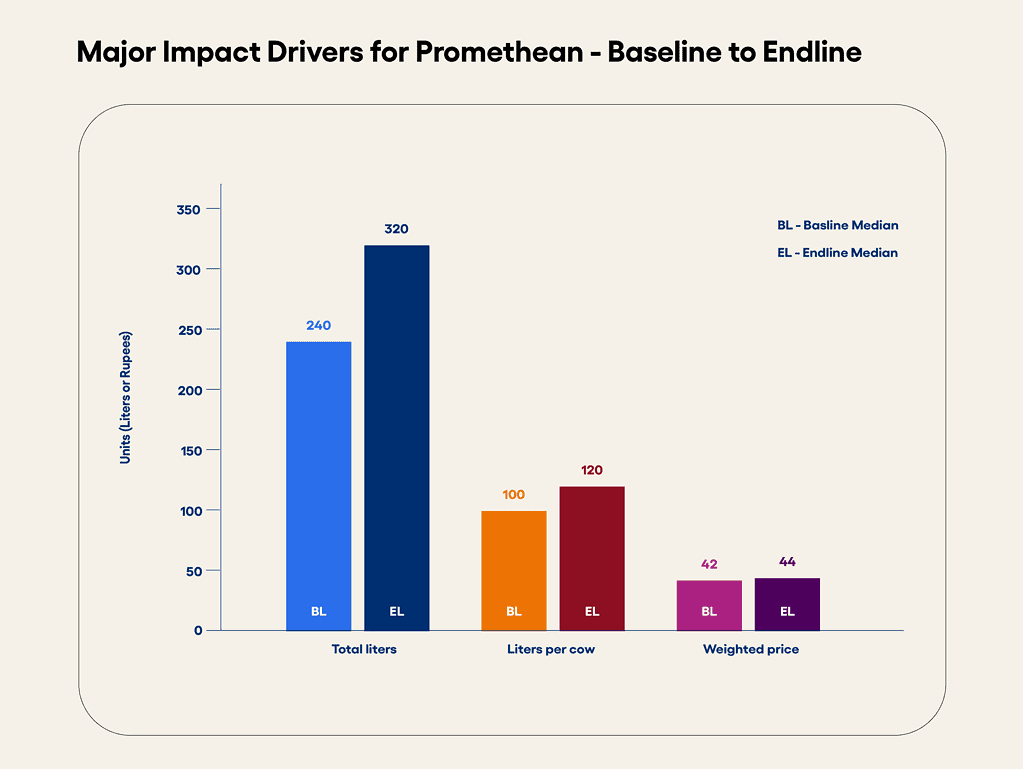

The survey results of Promethean’s customers closely matched its theory. Farmers sold 27% more liters per cow and 42% more liters overall. This increase came from three factors: better feed (which causes cows to produce more milk), less spoilage due to Promethean’s milk chillers, and larger herds because of access to credit. Costs for the median farmer almost doubled because farmers were investing more in feed and agrovet services. But those costs were small in comparison to the absolute revenue increases, which meant profits increased 61% at the median.

Koolboks

By using Koolboks’ solar-powered freezers, MSMEs can reduce their cost of utilities, increase their revenues by staying open for longer periods of time (even during power outages), and reduce losses due to food spoilage.

When customers were asked how much they spent on “power” and “related costs such as fuel and generator,” the study found that the company was successful in eliminating the need for diesel generators for refrigeration purposes. Median power costs fell 100%, with average costs down 40% (note that most customers purchased their Koolboks freezers in cash, but those who purchased on credit may or may not have included their loan payments here). Paying utilities was the largest expense for 34% of respondents at baseline; at endline this fell to 11%. While significant inflation made it difficult for households to see increased profits, the company succeeded in what it set out to do: drive down power costs for MSMEs.

Despite the present economy meltdown, my income keeps increasing due to the increase in my sales everyday.

Frozen goods seller, Koolboks

Lizard Earth

Through Lizard Earth’s training and assured market access, cocoa farmers expect to see improvements in volume and quality in the short-term, as well as an increase in the price for their product.

The survey results showed that the median price received per bag of cacao beans was 88% higher at the endline, although this was at least partially due to the global cocoa price hike during this period. The price and earnings received by farmers who were making the least amount of revenue at the baseline were even more pronounced. Those farmers increased their profits by 192% on average. This was a factor of both increased productivity (up 16%) and increased price (up 110%), while farmers who were already earning more revenue at the baseline reported less improvements in cocoa yield and quality. This data suggests that impact is closely related to the starting point of the respondents, and people living on less experience the greatest impact.

The changes I am seeing in my plantation are slow for now, but I believe it is a process; it will get better someday.

Cocoa farmer, Lizard Earth

Takeaways

There are three main lessons we take away from this research, with lots more in the report.

1. Measure what companies can control.

While we saw positive results on the drivers of income that companies sought to shift, overall household incomes for the median household fell for two out of three companies (Koolboks by 41%, Promethean by 28%). When people talk about poverty, household income understandably comes to mind. But total household income is rarely attributable to a single product or service. According to one study, the average household in Kenya had 10 sources of income.

Household income is also affected by macroeconomic forces like inflation or world market prices. Over the course of our study with Koolboks, a Nigerian-based company, the country’s economy experienced one of its worst periods, with inflation surging to 34% in June. While neither our companies nor their customers are immune to larger market forces, we undertook a study to look at what our companies could control. For example, we learned that Net Promoter Score (NPS) and challenge rates —metrics that companies can control — can be proxies for income increases, which investors can use to understand the impact of the company on its customers.

2. Productive use of energy (PUE) companies and innovative agribusinesses are building economic resilience despite macroeconomic factors.

Across all three companies, income from the relevant MSME increased as a portion of household income. While these interventions did not provide a silver bullet in turbulent times, they did provide stable sources of income. When economies grow, companies’ interventions may help customers grow even more. And when economies struggle, company interventions very likely help customers build resilience; without these interventions, customers could have fallen even deeper into poverty.

3. Impact changes over time. Our tools should acknowledge that.

The preparation and implementation of these studies took 18 months, but if we want to understand the long-term impacts of social enterprises, it will take a lot more time and data. Longitudinal data like this helps both companies and investors understand the customer journey and identify what can be improved. Companies need time to iterate and refine their product or service, Patient Capital to invest in their operations, and data to make better decisions.

The only way we can know if we are getting closer to solving problems of poverty is by measuring our progress and the impact of our companies. We are committed to doing that in a way which reflects the lived experience of customers and is useful for companies. We hope you will join us in this work.