The ag tech that smallholder farmers actually need

As the number of ag tech start-ups grows, one audience is often missing from the equation: smallholder farmers.

- Blog

- Cross sector

- Cross region

Technology during the Green Revolution radically transformed agricultural production, increasing yields dramatically and saving billions of lives from hunger. As climate change increasingly affects farmers and causes food insecurity to rise, the need for tech-based solutions to help farmers become more resilient and efficient to feed the masses is clear. Yet while the $18 billion ag-tech industry is rebounding from a dip in 2022 and the number of start-ups are growing, one audience is often missing from the equation: smallholder farmers.

Smallholders make up 80% of the world’s farmers, primarily based in Africa, Asia, and Latin America. Dependent on agriculture for their livelihoods, these 600 million smallholders also produce 30%-34% of the global food supply, meaning the opportunity for impact is huge.

Despite this incredible contribution to global food systems, the majority of ag tech solutions are not built for the contexts that smallholder farmers exist in or the challenges they face. While the barriers for tech companies to reach smallholder markets are real, the opportunities likely outweigh them. In sub-Saharan Africa, the potential market for solar irrigation is projected to reach $1.6 billion by 2030 for smallholder farmers able to afford current solutions, encompassing around 2.8 million farmers. In Acumen’s experience, tech companies best suited to smallholder farmers focus on three primary dimensions: accessibility, affordability, and clear return on investment.

The smallholder ag tech landscape

Despite the fact that a wide spectrum of ag tech solutions exist, most funders focus on mid-to-large scale farms in the Americas and Europe, leaving smallholder farmers in the rest of the world largely behind. Impact investing in smallholder agriculture has only recently started to emerge from “niche” to “norm” in the past decade. In Latin America, for instance, only 15% of the $440 million ag tech industry is built for smallholders. While Kenya and Nigeria are often praised for their startup ecosystems, their ag tech ecosystems, like those across sub-Saharan Africa, are still in early stages.

In 2024, the largest amount of funding has gone towards verticals such as precision ag ($4.7 billion), marketplaces ($2.5 billion), and AI ($1.3 billion). While these types of solutions are important, exciting, and potentially impactful, we have found that these are rarely affordable for smallholders, and are generally less relevant for small scale farms.

Based on our experience, these interventions are more likely to add value for smallholder farmers:

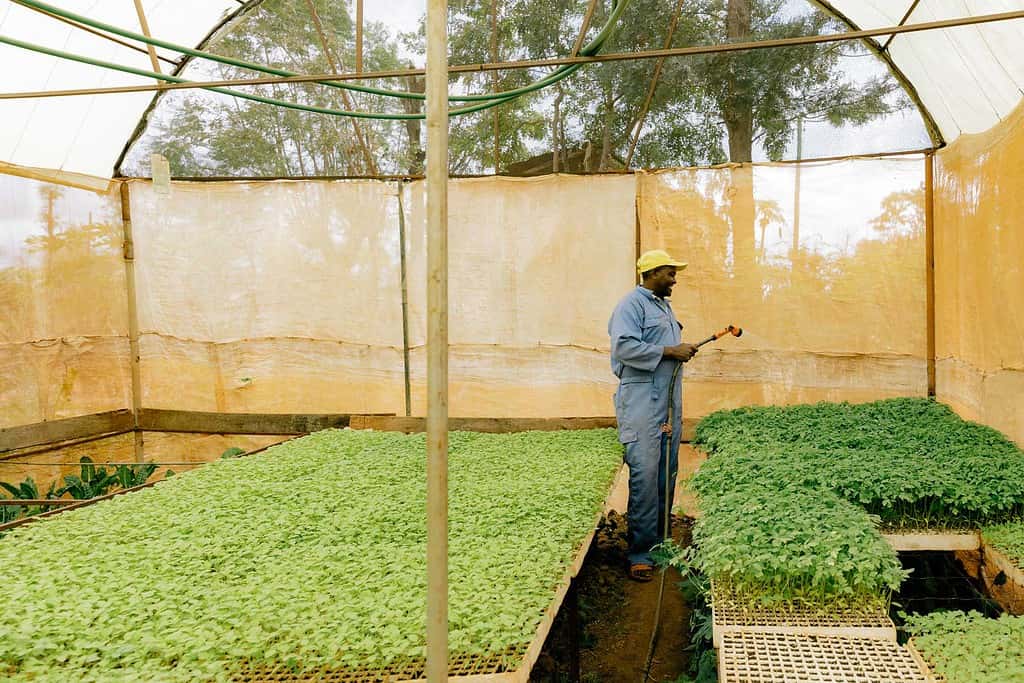

- Input technology: Solutions like SunCulture’s solar-powered irrigation system and Kheyti’s greenhouse-in-a-box have helped farmers improve their yields and adapt to climate change.

- Digital logistics and operations: Logistics and operations are one of the biggest pain points in agriculture. East Africa Foods leverages data and technology for aggregation and distribution of produce.

- Processing and storage: Companies like S4S and CropBank provide technology to farmers that allows them to capture more value through processing and preventing post-harvest loss.

As important as the tech solutions, however, are the business models that can ensure that the innovation is affordable and accessible to smallholder farmers. Across our agriculture portfolio, business models that bundle technology with other services, such as financing, extension, and increasingly, market access, have shown the most penetration of smallholder farmer communities. These types of bundled solutions help smallholder farmers adopt technology at faster rates than farmers without such offerings, but they also come with their own host of challenges.

Challenges for ag tech companies

Generally, ag tech investors and entrepreneurs face four unique challenges when it comes to serving smallholder farmers:

- Low farmer literacy levels: On average, rural smallholders face lower literacy rates than their urban counterparts—especially women smallholders.

- Infrastructure challenges: Some farmers in rural, remote areas forgo electricity due to its cost—and related, only one in four people in low-income countries use the internet for this reason.

- Financing options: For smallholders wanting to invest in technology, one of the biggest barriers they face is lack of access to capital. Local financial institutions perceive smallholders as too risky to invest in, or they do not offer specialized financial products that meet farmers’ needs.

- Unclear return on investment for farmers: Smallholders have limited income, and they cannot afford to invest in new technologies. If companies and investors want farmers to adopt new technologies, they need to demonstrate and ensure increases in productivity and profitability for farmers.

When adopted, tech has the potential to provide significant income increases for smallholders’ households. But in order to unlock those opportunities, agribusinesses need investors who are willing to accept lower return expectations, given the higher costs. Companies and entrepreneurs need to approach these challenges with a deeper level of intentionality in understanding smallholder farmers’ context when developing solutions.

Building ag tech solutions around the smallholder farmer

S4S provides female micro-entrepreneurs in India with solar-powered technology for food preservation and processing, enabling them to create new products and earn better incomes. S4S conducts rigorous, on-going training for their micro-entrepreneurs who operate and run solar grain mills. Given that only 69% of women in India are literate, this in-person training is crucial. They also organize common training sessions across villages and encourage peer-to-peer learning, proven to be most successful for tech adoption.

Additionally, although India claimed to electrify all villages in 2018, not all Indians have access to power. India’s definition of electrification only requires basic electrical infrastructure and at least 10% of households and public spaces having power. These infrastructure deficits require ag tech providers to adapt to country-specific contexts. For S4S, this meant directly communicating with the electric board in India. S4S asked the electric board to turn on the electricity for their grain miller factories during the key hours of the day to limit power outages in the communities where S4S operates. S4S solar dehydrators operate independently of the electrical supply.

“We can now buy seeds and fertilizers for our farm, no need to take loans. The machine gives us an additional income and supports our farming.”

Micro-entrepreneur, S4S

SunCulture helps smallholder farmers grow more food with climate technology, financing, and a digital marketplace. The company is the largest provider of smallholder farmer solar irrigation systems in sub-Saharan Africa, with operations in Kenya, Uganda, and Côte d’Ivoire, and distribution partnerships in Ethiopia, Togo, and Zambia.

Given that irrigation systems can be expensive, SunCulture coupled its tech with an affordable and accessible financing option, known as “Pay-As-You-Grow” (PAYGrow). Customers who opt into its PAYGrow offering commit a small down payment followed by monthly installments for 24-30 months, instead of the full cash price. Perhaps most importantly, SunCulture’s customers typically see returns for the solar irrigation systems within one growing season. SunCulture empowers smallholder farmers to boost their productivity and improve their livelihoods.

“I have been able to diversify my farming since I can now easily irrigate my farm. Because of the pump, I am now able to plant different types of crops which enables me to boost my productivity and income.”

Female farmer, SunCulture

We need more context-specific ag tech solutions

S4S and SunCulture have been able to drive farmer adoption because their solutions are built for the contexts in which they operate. These solutions address issues of accessibility, from limited internet access to unstable electricity, and the return on investment is clear. Acumen’s early-stage agricultural investment initiative, Trellis, plans to invest in more of these types of companies that provide farmers with bundled solutions. A strong ag tech ecosystem needs more capital and more entrepreneurs who can build the right types of solutions. Digital-only solutions are not enough for farmers, but when they are paired with the right inputs and services, they can create additional value for smallholders and unlock new market opportunities. Investments into agribusinesses like S4S and SunCulture allow technology to continue to revolutionize agriculture, but this time with the smallholder farmer at the center.

Photos courtesy of Tulima Solar, S4S Technologies and SunCulture